Hello Readers,

In this article, I’m diving into a simple example to show why it’s okay to pay a higher price for companies with strong earnings growth potential and how consistent growth compounds companies value/stock price. By the end, you’ll understand why some companies have sky-high P/E ratios compared to others, and why smart investors are happy to pay that premium.

Heads-Up: I’ve pulled some material from a past post, but I’ve expanded it with fresh insights to make the valuation concept crystal clear.

If you missed the previous post in this series, check it out:

Analyzing Moat - Does the Company have a Competitive Advantage?

Management Analysis - The Ultimate Edge in Long-Term Investing

How to analyze a company - this provides high-level steps to analyze a company like a pro investor

Valuation is crucial before investing in any company. Even a great business can become a poor investment if you overpay for it.

In the long run, a company's stock price follows its intrinsic value. However, in the short term, stock prices fluctuate due to factors such as company news, competitive pressures, and macroeconomic conditions. Understanding this distinction is key to making sound investment decisions.

How do investors determine what a business is worth?

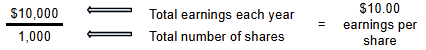

Let’s use the “Great Coffee Company” example, which we used to learn about the P/E ratio. Assume that the Great Coffee Company has only one location, 1,000 shares outstanding, and earns $10,000 each year. This means the company earns about $10 per share.

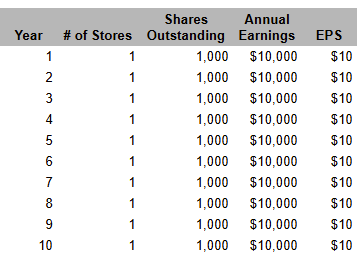

Let’s also assume that the company’s earnings stay the same for the foreseeable future and that the Great Coffee Company's earnings are $10,000 each year. Here is how the financials will look over the next decade:

What would you be willing to pay to own a share of Great Coffee Company with the financials shown above?

Let’s say you are only willing to pay $40 for one share, and the Great Coffee company shareholder accepts the price. What is your return on investment?

To calculate the return, you divide the yearly earnings by the price paid for the share. In this case, it is a 25% return on your investment, which is really high compared to the 2%-3% you receive at a bank on your savings account.

Let’s look at a different scenario where you are comfortable paying $100 for the stock, and shareholders are willing to see it at that price. In this scenario, your return on the purchase of the share is 10%, which is much more reasonable.

The PE ratio for this stock is 10X.

If you are comfortable with this return, you should purchase the stock. Note that the above example we went over is an incredibly simple scenario of how stocks are valued. The price is determined by a balancing act between the buyers and sellers.

Importance of growth

Now, let’s assume the Great Coffee Company reinvests all its profits to expand its business instead of distributing dividends.

The company decided to open one new coffee shop every year for the next 10 years.

Each coffee shop generates the same $10,000 in annual earnings.

By Year 10, the company has 10 locations, generating $100,000 in total annual earnings.

If investors still expect a 10% return, the company’s new valuation would be:

If you are comfortable with a 10% return on your investment & the sellers are comfortable selling the stock at that price, then the price of a share will be $1,000

So if you have invested in Great Coffee Company at $10/share, before they decided to expand, you have made a 10X return.

Stock price increases from $100 → $1,000 in 10 years (900% gain).

How do Dividends impact your Return on Investment?

Now, let’s assume Great Coffee Company also decides to pay an annual dividend of $1 per share to investors.

Your total return would be:

Stock Price Growth + Dividends Earned

$100 → $1,000 in 10 years+Dividend Income

This results in a 910% total return on your initial investment.

Valuation - How growth drives value

“Price is what you pay and value is what you get”

To understand the value of a company I prefer a few methods:

Earnings Growth Model:

Expected annual return = Earnings growth + Shareholder Yield +/- PE Expansion

This will tell us as an Investor how much annual return you can expect investing in the stock

Example: Below is expected return for ODFL 0.00%↑

Earnings Growth- 10% over the next 10 years

Shareholder yeild- 3.6% (0.6% + 3% annual share buyback

PE Multiple Expansion- Forward PE might decline from current 32.4X to its 10 year historical average of 26.5X.

Expected Annual Return: 10% + 3.6% +0.1*((26.5-32.4)/32.4)= 11.8%

This is above 10% Threshold I would love to see!

Reverse DCF - understand growth rates that are already baked into the current stock price.

Reverse DCF is a quick & easy way to understand if the current price and the expected growth rates are acheivable by the management and is there enough “Margin of Safety” in the current price

You only need to know 3 things:

The current stock price of the company

The number of shares outstanding

The Free Cash Flow in Year 1

For $ODFL, at current price, the companies FCF has to grow ~13.5% to justify current price of $158. As an investor, if you believe that the company can grow above 15% then it makes sense to buy!

To keep this article short, I will post another article tomorrow going deeper into “Reverse DFC” including examples of companies and a template to help you interpret the results.

The Best Investors are those who can think long term.

Historically, the S&P 500 Index has delivered an average annual return of ~10% (including dividends).

If you’re comfortable with this return, simply investing in an S&P 500 index fund and holding for the long term is a great strategy for most investors.

However, if you seek higher returns, you must identify companies with a competitive advantage that can grow significantly over time.

Conclusion:

Think long-term: Buy stocks for less than their intrinsic value and let them grow.

Ignore short-term noise: Stock prices fluctuate daily, but in the long run, they follow earnings growth.

Seek high ROIC: Companies with a high return on invested capital (ROIC) grow faster than their competitors, leading to higher stock price appreciation.

Your total return = Earnings growth + Dividends

The above examples are simplified versions of how to value a stock. I will go into the details while I provide an in-depth analysis of companies in my later posts.

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks. Steady Investing has a true passion for investing and helping other investors.

I did not come from a finance background, and it took me nearly 10 years from learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, I have outperformed the S&P 500 by over 100%—up 140% vs. 37% for the S&P 500 index, with an annualized return of over 43% (inception date Nov’22).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Population is growing, Cost of Living is growing, of course so must the profit of any business to survive.

.

Without growth, a business is dying.