Welcome back to our Substack series on becoming a smarter investor! So far, we’ve tackled ROIC, business models, and management track records (in case you missed - links below). Today, we’re diving into a concept that can make or break a company’s long-term success: its moat. A moat is like a protective shield around a business, keeping competitors at bay and ensuring it can thrive for years. Let’s explore what a moat is, how to spot one, the different types of moats, and real-world examples from companies like Apple, Amazon, and Coca-Cola to bring this idea to life. By the end, you’ll know how to find companies with a lasting edge, and why that matters for your investments.

If you missed the previous post in this series, check it out:

Management Analysis - The Ultimate Edge in Long-Term Investing

How to analyze a company - this provides high-level steps to analyze a company like a pro investor

Next in this series:

Growth, Profitability & Healthy Balance Sheet

Future Growth & Valuation

Don’t forget to subscribe so you don’t miss the rest of this deep-dive series.

Each topic is designed to give you practical tools and knowledge to analyze businesses like a pro.

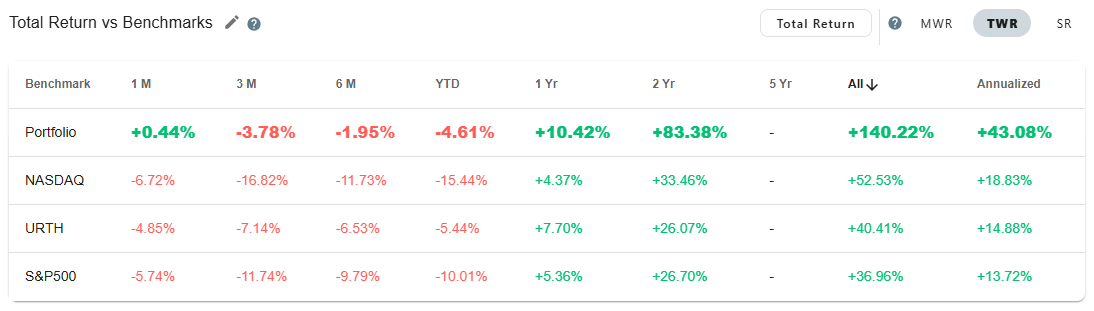

Following a consistent process and checklist has helped Steady Investing's portfolio (as of 4/21/2025) outperform the S&P 500 by over 100% - up 140% vs. 37% for the S&P 500 index, with an annualized return of over 43% (inception date Nov’22).

Let’s dive in!

What Is a Moat?

A moat is a company’s sustainable competitive advantage. It’s the set of structural advantages that protect a business from competitors and help it maintain pricing power, market share, and profitability over time.

Think of a medieval castle. The moat around it protects it from invaders. In the business world, a company’s moat keeps competitors from easily taking away its customers, profits, or place in the market

How Do You Know If a Company Has a Moat?

It’s not always obvious. But there are a few signs to look for:

High and consistent return on invested capital (ROIC)

Strong pricing power

Loyal customer base

Market share leadership

Low turnover in products or services

You’ll often see moats reflected in a company’s financials and customer behavior. A company with a high moat will see a consistent increase in market share and can increase prices over the inflation rates and still not lose customers. But to truly evaluate a moat, it helps to understand where it comes from.

Types of Moats: The Five Big Sources

Moats come in different flavors, each giving a company a unique edge. Here are the five main types, with examples to make them clear.

1. Intangible Assets

These are things you can’t touch but are super valuable, like a strong brand, patents, or government licenses. A powerful brand makes customers choose a company over cheaper rivals, while patents block competitors from copying products.

Example: Coca-Cola

Coca-Cola’s brand is one of the most recognized in the world, valued at $35 billion in 2024. People pick Coke over generic colas, even if they’re cheaper, because the brand stands for happiness and memories! Coca-Cola also has secret recipes and trademarks that competitors can’t replicate. This intangible moat has kept Coca-Cola a leader in beverages for over a century, with $46.5 billion in revenue in 2024.

2. Switching Costs

Switching costs happen when it’s hard or expensive for customers to leave a company for a competitor. This could be due to time, money, or the hassle involved in switching.

Example: Apple

Apple’s ecosystem creates massive switching costs. If you own an iPhone, you’re likely to have an Apple Watch, AirPods, and iCloud—all of which work seamlessly together. Switching to an Android phone means losing that integration, re-learning a new system, and maybe even repurchasing apps or accessories. In 2024, Apple’s services revenue (like iCloud and Apple Music) hit $85.2 billion, up 14% year-over-year, showing how “locked-in” customers are. That’s a moat that keeps Apple’s 1.5 billion active users coming back.

3. Network Effects

A network effect happens when a product gets more valuable as more people use it. Think of a party—the more friends who show up, the better it gets. In business, this makes it tough for competitors to catch up once a company takes the lead.

Example: Amazon (Marketplace)

Amazon’s marketplace has a powerful network effect. In 2024, Amazon had over 300 million active buyers and 2.5 million sellers on its platform. The more buyers use Amazon, the more sellers want to join to reach those customers. And the more sellers there are, the more products buyers can find, making Amazon even more attractive. This cycle helped Amazon’s marketplace generate $575 billion in gross merchandise value in 2024. A new online store can’t compete easily—Amazon’s network is too big to challenge.

4. Cost Advantages

Some companies can produce goods or services cheaper than anyone else, either through scale, unique processes, or access to resources. This lets them undercut competitors on price or keep higher profits.

Example: Walmart

Walmart’s cost advantage comes from its massive scale. With $648 billion in revenue in 2024, Walmart buys products in huge quantities, negotiating lower prices from suppliers than smaller stores can. It also has an efficient supply chain, with 210 distribution centers globally, keeping shipping costs low. This lets Walmart offer everyday low prices, like a $2 gallon of milk when competitors charge $3, while still making a profit. Smaller retailers can’t match that, giving Walmart a moat in retail.

5. Efficient Scale

This applies to companies in industries where only a few players can profitably exist due to limited demand. Think of a small town with just enough customers for one coffee shop—opening a second one would mean neither makes money.

Example: Union Pacific (Railroads)

Union Pacific operates railroads in the western U.S., a business with efficient scale. Building a railroad is crazy expensive tracks, trains, and land rights costing billions. In 2024, Union Pacific had $24.1 billion in revenue, dominating rail transport in its region. There’s not enough demand for another railroad to compete profitably in the same area, so Union Pacific faces little competition. This efficient scale moat lets it maintain high margins (38% operating margin in 2024) with minimal threat.

Why Moats Matter to You

A company with a strong moat is like a castle that can withstand attacks—it’s more likely to keep growing your investment over decades. Without a moat, a company might do well for a few years but get crushed by competitors. Look at Apple: its switching costs and brand (an intangible asset) helped it grow revenue to $383 billion in 2024, even in a tough smartphone market. Compare that to a company like Nokia, which dominated mobile phones in the 2000s but had no moat to stop Apple and Android from taking over—by 2013, Nokia’s phone business was sold off.

How to Spot a Moat Yourself

Start by asking: What makes this company special? Check their financials—consistent high margins (like Coca-Cola’s 30% operating margin) or steady market share growth (like Amazon’s 40% of U.S. e-commerce) are good signs. Read their annual report to see if they talk about unique advantages, like patents or scale. Then, look at competitors: If rivals are struggling to catch up, the company likely has a moat.

Moats Are Not Forever

It’s important to remember that moats can erode. A strong brand can lose relevance. Technology can reduce switching costs. A regulatory change can level the playing field. So while moats are a huge plus, we must constantly reevaluate them.

Ask yourself:

Is the moat widening or shrinking?

Is management reinvesting to strengthen the advantage?

Are competitors catching up?

Final Thoughts

The best investments are in companies with wide and durable moats that allow them to compound returns over long periods.

Here’s a simple framework to guide your analysis:

Do customers stick around, even if prices rise?

Are competitors able to replicate what this company does?

Is the company protected by brand, cost, tech, or scale advantages?

Can it reinvest at high returns because of this edge?

If the answer to most of these is yes, you may have found a moat worth backing.

That’s it for today! Hope you enjoyed it!

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks. Steady Investing has a true passion for investing and helping other investors.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, I have outperformed the S&P 500 by over 100% - up 140% vs. 37% for the S&P 500 index with an annualized return of over 43% (inception date Nov’22).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Competitive Advantages

- Top Line: GPA, Asset Turnover, Gross Profit Turnover

- Bottom Line: ROA, ROIC