I’m running a quick poll! Do you prefer:

📌 Top stock picks with high-level analysis & valuation thesis, like this post?

📌 Deep dives into individual companies?

Vote and let me know so I can focus on what you find most valuable. Thanks!

Year-to-date, the S&P 500 Index dropped by 4.13%, and the market emotion is trending towards “Extreme Fear”.

“Be fearful when others are greedy, and be greedy when others are fearful"-Warren Buffett

Now let’s dive into the Top 5 Picks. These stocks align with my core investing philosophy:

✅ Highly undervalued opportunities

✅ Heads I win, tails I don’t lose approach

✅ Strong moat & high barriers to entry

✅ Solid business fundamentals

✅ Led by great managers with skin in the game

5 - Watsco ($WSO)

Business Model?

Watsco is the largest distributor of heating, air conditioning, and refrigeration (HVAC/R) products with locations in the United States, Canada & Mexico.

Is the business easy to understand?

The company serves contractors and dealers that service the replacement and new construction markets for residential and light commercial central air conditioning, heating, and refrigeration systems.

Source: Investor Presentations

Long-Term Growth Prospects?

We know the planet is getting warmer—global warming

Every year EPA implements new regulations to reduce Greenhouse gases. Starting January 1, 2025, the EPA is implementing new regulations that mandate the use of lower-GWP refrigerants in new HVAC systems, phasing out refrigerants like R-410A that have a high global warming potential.

According to data published in March 2023 by the Energy Information Administration, there are approximately 102 million HVAC systems installed in the United States that have been in service for more than 10 years, most of which operate well below current minimum efficiency standards.

Source: Investor Presentations

We expect to see this trend to continue in the long-term

Is it a Good Business?

1. Historical performance: WSO has returned 36,681% return a 20.8% CAGR return from 1990 to 2025. If you have invested $10K in 1990 it would be $3.7M

2. Moat: Market leader in a fragmented market with significant barriers to entry. Purchasing power from $1,400 OEM’s

Serial Acquirer: Since its IPO, WSO has acquired more than 70 companies, expanding its footprint and increasing its market share.

3. Barrier to Entry: high barrier to entry since OEM approval is required to enter distribution.

4. Ownership: 60% of the voting power is by insiders.

Valuation:

Expected Return using Earnings Growth Model: 10%

Reverse DCF: Watsco should grow FCF at 10.5% per year to return 10%* per year to the shareholders, which I believe it can achieve and exceed.

*I use 10% as my threshold—my opportunity cost of capital. If I don’t believe a company can generate at least a 10% annual return, I’d rather invest in the S&P 500 index.

4 - Zoetis ($ZTS)

Business Model?

Zoetis Inc. (ZTS) is a global leader in animal health. They focus on the discovery, development, manufacturing, and commercialization of medicines, vaccines, diagnostic products, and other technologies for livestock (cattle, swine, poultry) and companion animals (dogs, cats, horses).

Zoetis is a spin-off of Pfizer animal health business

Is the business easy to understand?

At its core, their business model revolves around:

Selling medications and vaccines for pets and farm animals.

Providing diagnostic tools and technologies to detect and manage animal diseases.

Offering digital and genetic solutions to improve animal health outcomes and boost productivity for farmers.

Long-Term Growth Prospects?

In the US and across the world, people living alone and getting married later in life is increasing. What is the solution to lineless- PETS

Dog and Cat ownership has been increasing in the last decade, and the global pet care market is projected to reach $597.5 B by 2033, exhibiting a CAGR of 7.03% between 2024 and 2033.

We expect to see this trend in the long term.

Is it a Good Business?

1. Historical performance: Since the IPO in 2013, ZTS has returned 470% return to shareholders, a CAGR of 15.4%. So $10K invested will be $57K

2. Moat: ZTS is a spin-off of Pfizer, and has cutting-edge technology to produce new vaccinations & medicines

3. Barrier to Entry: High barrier to entry as it needs expertise in innovation and distribution. A lot of these vaccines need to be approved before they can enter the market. It gets complex, especially when dealing with various countries.

4. Ownership: Insider ownership is a small % of the total outstanding shares but the executive’s compensation plan is heavily geared towards shares.

Valuation:

Expected Return using Earnings Growth Model: 10%

Reverse DCF: Zoetis should grow its FCF by 14% per year to return 10% per year to shareholders. Which should be attainable!

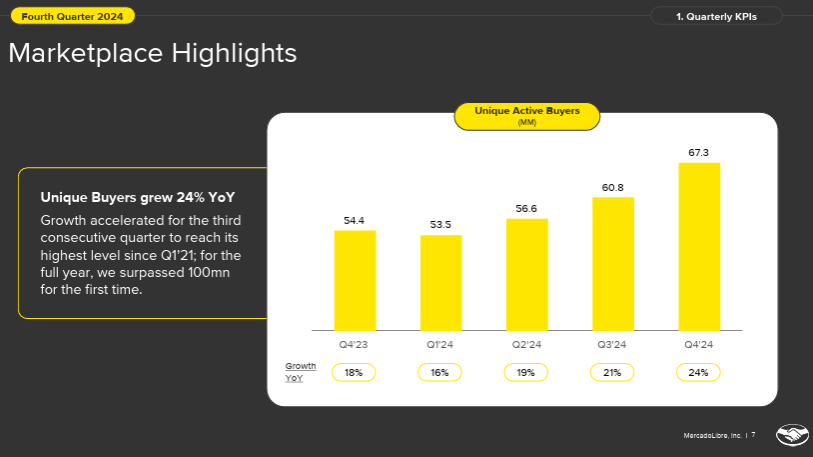

3 - Mercado Libre Inc ($MELI)

Business Model?

Mercado Libre, Inc. is the leading online commerce and fintech ecosystem in Latin America. Their business model is similar to Amazon.

Their Fintech Arm, Mercado Pago, offers digital wallets and other credit offerings.

Is the business easy to understand?

They make money by facilitating online sales, processing payments, and offering additional services (logistics, advertising, etc.) to their sellers.

Long-Term Growth Prospects?

Meli stands as the undisputed king of Latin American e-commerce with nearly 25% of the market. Its sprawling ecosystem of e-commerce and payment solutions creates a network effect that's incredibly hard to rival.

With a powerful ecosystem combining e-commerce, fintech, logistics, and ads, MELI creates a flywheel effect, attracting more buyers and sellers while expanding into new markets.

Is it a Good Business?

1. Historical performance: Since the IPO in 2007, MELI has returned 7,276% return to shareholders, a CAGR of 27.6%. So $10K invested will be $734K

2. Moat: MELI’s business is built on Ecosystem integration- combining e-Commerce, Fintech, logistics & advertising creating a flywheel effect. Similar to Amazon, once they have a large market share, they have pricing power to improve margins and expand into other areas.

3. Barrier to Entry: The scale of their platform, brand trust, and localized expertise in Latin American markets make it hard for new entrants to replicate their model.

4. Ownership: Co-Founder Marcos Galperin, still runs the company and has a Jeff Bezos attitude towards growing MELI

Valuation:

Expected Return using Earnings Growth Model: 17%

Reverse DCF: MELI should grow its FCF by 3 % per year to return 10% per year to shareholders.

I believe MELI is undervalued by ~60%

2 - Evolution AB ($EVO)

Business Model?

Evolution Gaming is a market leader in developing fully integrated B2B Online Casino solutions. The core of their offering is traditional table games like Roulette & Blackjack in the US, Europe Asia & other countries.

Is the business easy to understand?

Evolution Gaming isn’t a casino operator. They create online casino games and casino operators that use these games pay a commission to Evolution Gaming on their winnings.

Long-Term Growth Prospects?

Online Gambling became legal in 2005 & 2006 in the US and Europe and has seen significant growth since. Online Gambling is expected to reach $63 billion just in the US by 2030. EVO has 70% of the market share of this growing business, the clear market leader

Is it a Good Business?

1. Historical performance: Since its IPO in 2015, KNSL has returned 4,890% return to shareholders, a CAGR of 47.9%. So a $10K invested will be $499K.

2. Moat: Evolution Gaming has managed to create a superior product compared to its primary competitors. Furthermore, industry experts have consistently attested to the fact that Evolution Gaming's games deliver a higher return on investment for casino operators.

3. Barrier to Entry: Evolution Gaming is widely recognized as an industry leader, owning the most valuable proprietary game intellectual property. When casino operators choose alternative live dealer solutions that fail to match Evolution's high-quality standards, they risk losing customers to competing platforms that deliver a superior gaming experience.

4. Ownership: Co-Founder Jens Bahr owns 10.5% of the company.

Valuation:

Recent strikes in Georgia and the EU Commission investigation into online gambling licenses’ hurt the stock price. The company trades at one of its cheapest valuation levels ever.

Expected Return using Earnings Growth Model: 22%

Reverse DCF: EVO.AB should grow its FCF by 7% per year to return 10% per year to shareholders.

I believe EVO is undervalued by ~70%

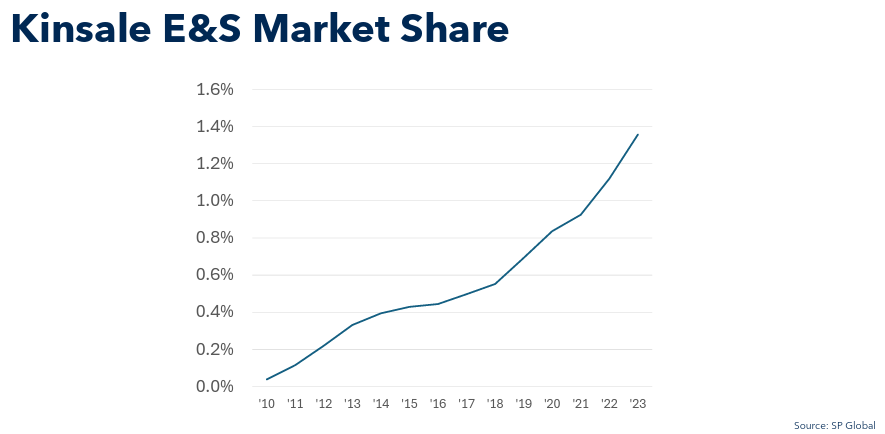

1 - Kinsale Capital ($KNSL)

Business Model?

Kinsale Capital Group, Inc. (NYSE: KNSL) is a specialty insurance company focusing on the excess and surplus lines (E&S) market in the United States.

Their revenue comes from premiums paid by policyholders, and they aim to profit by using advanced technology, and expert knowledge & keeping costs low.

Is the business easy to understand?

Kinsale focuses on excess and surplus (E&S) lines insurance, essentially, they insure risks that standard insurance companies avoid. These could be unusual, high-risk, or hard-to-price situations.

Long-Term Growth Prospects?

The Excess & Surplus market is a very fragmented market and most of the big insurance companies are not interested in entering this space. KNSL’s total E&S market share is ~1.4%. There is a tremendous opportunity to grow in this space.

Is it a Good Business?

1. Historical performance: Since its IPO in 2016, KNSL has returned 2,433% return to shareholders, a CAGR of 45.4%. So $10K invested will be $253K

2. Moat: Kinsale Capital (KNSL) specializes in underwriting hard-to-insure risks, leveraging AI and proprietary technology to deliver fast and efficient underwriting while maintaining low-cost operations. Their expense ratio stands at 55%, significantly lower than the industry average of around 70%.

3. Barrier to Entry: KNSL benefits from strong barriers to entry due to its specialized underwriting expertise in the E&S insurance market, proprietary technology for efficient risk assessment, and established relationships with independent brokers. Their lean operations and disciplined approach to pricing make it difficult for new entrants to compete effectively. Additionally, building the technical expertise and trust needed to succeed in this niche takes significant time and investment

4. Ownership: Founder Michael Kehoe, who is a veteran in the E&S industry, still runs the company and very long-term thinker. Insiders own more than 5% of the company

Valuation:

Expected Return using Earnings Growth Model: 15%

Reverse DCF: KNSL should grow its FCF by 7% per year to return 10% per year to shareholders.

I believe KNSL is undervalued by ~70%

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since tracking my performance, I have achieved a 40% compound annual growth rate (CAGR).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Nice read! Straight and to the point.

So much depth into this article.