Hi Steady Investing Community!

A couple of weeks ago, I shared a quick update on our portfolio’s performance and mentioned that I’d follow up with more detail. I intended to post it sooner, but with all the market volatility lately, things got a bit delayed.

That said, I’ve used this time productively to strengthen my portfolio by re-evaluating positions with a fresh perspective. As a result, I exited a few positions where my conviction has weakened, added $100K cash, and initiated 4 new positions from my watchlist where I see stronger long-term growth potential and better risk-reward setups.

As I mentioned in the Investing Philosophy post, the goal of Steady Investing is to outperform the market by 3–4% annually over the long term (>5 years), and more importantly, to help others do the same.

I’ve been investing for over a decade, and like many, I made plenty of mistakes early on. I was lucky to make mistakes early on when the stakes were smaller, but those lessons have been invaluable. Through this platform, I genuinely want to share what I’ve learned by breaking down complex investing concepts into simple, actionable insights that can help others navigate the market with confidence and clarity.

Steady Investing Portfolio Performance

We have had an excellent performance of the portfolio since our inception in November of 2022. I have slowly started building my portfolio, and now I have $500K set aside to manage the Steady Investing Portfolio. So I use my own money to invest in this portfolio, and I am invested in the same ideas I share - so when I win, we all win!

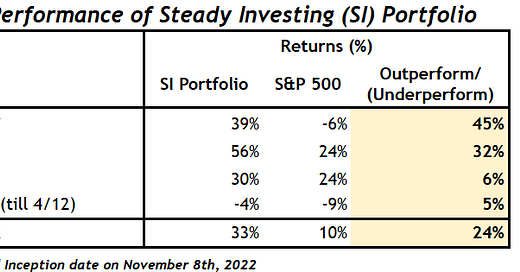

The Steady Investing’s performance can be found below (Fund inception date on November 8th, 2022):

Since Inception, we have outperformed the market every year! Even in current times where the market is very volatile, our portfolio outperformed the S&P 500 Index.

We achieved this following a structured framework to gain a clear understanding of the business, its financial health, and the industry it operates in.

You can read my framework in my post “How to Analyze a Company.”

One of the great things about writing investment cases is that you can apply the same structured approach to each one! This provides us with consistency and helps us think through every detail of the company, industry, and competitors before making the final decision.

While I do my analysis, I aim to say “NO” to a company quickly. If by the end of the analysis if every box ticks. I will do my valuation and wait for the right opportunity to buy. Always remember:

“Price is what you pay and Value is what you get”

Even if you find a quality company run by great managers, you have to make sure you are buying it a price where you have a lot of Margin of Safety.

At the core of our investment philosophy is a simple but powerful approach:

Invest in high-quality businesses with durable competitive advantages

Focus on Owner-operator, already profitable & in monopoly/oligopoly industry

Back exceptional management teams with a track record of smart capital allocation

Buy only when these companies are trading at reasonable or undervalued prices

Our Portfolio looks like this:

Three of our portfolio companies have already delivered returns of over 100%—and I believe there are at least three more that are currently undervalued by over 75%, trading at depressed levels due to short-term market conditions.

This sets the stage for what I believe will be continued outperformance over the next few years.

In the long run, one principle holds true:

“Stock prices always follow the growth in earnings.”

Here’s a quick snapshot of some of our standout performers—and what I believe lies ahead:

📈 Kinsale Capital (KNSL) — +29% since entry

A specialty insurance company focused on the U.S. Excess & Surplus (E&S) market. Kinsale is well-established and still expanding, with a disciplined underwriting model and strong operating leverage.

📌 My top stock pick for 2025 — I believe it remains undervalued by ~75% despite recent gains. [more details here.]

🚘 Uber Technologies (UBER) — +183% since 2023

Operating in a near-monopoly/oligopoly in the U.S. with 76 %+ market share, and 25 %+ in the highly fragmented global ride-hailing market, Uber has become profitable and is entering a new phase of margin expansion and scale-driven growth.

🔐 Zscaler (ZS) — +103% since entry

A clear leader in cloud-native cybersecurity. Zscaler’s Zero Trust Exchange is redefining secure access in the modern enterprise.

Its Free Cash Flow has grown from -$13M in 2017 to over $700M in 2025—a stunning trajectory, with plenty of runway ahead.

🔄 What’s Next?

Several of the newer positions (with single-digit returns so far) were added just in the past week during recent market volatility. These are long-term plays where I believe the risk/reward is heavily skewed in our favor.

Conclusion

Portfolio has performed exceptionally well since its inception. Our Compounded Annual Growth Rate (CAGR) is 33% vs 10% for the S&P 500.

I do not think we will outperform the market at this level forever but my goal is to outperform the Market by 3%-4% per year over the long term (>5 years)

Today, we own 12 wonderful companies. Over the next few months, we will probably add 3-4 more stocks to become fully invested portfolio.

Using Reverse DCF, Most companies we currently own are undervalued, some are undervalued by over 70%!

That’s it for today!

To learn more about my investment process and philosophy, read my articles:

I spend 50+ hours a week reading, researching, and analyzing stocks to find the best companies to add to a steady Investing portfolio. Please Subscribe and Share to support my work.

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks. Steady Investing has a true passion for investing and helping other investors.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, I have beaten the S&P 500 Index every year on average by 20 %+ and have achieved a 40% compound annual growth rate (CAGR).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Congratulations on the impressive track record! Love the investment ideas you bring to Substack! All of which are quite new to me and I need to dive into one day.