Management Analysis - The Ultimate Edge in Long-Term Investing

Skin in the Game: The Secret Weapon of Exceptional Companies

"When you buy a stock, you get the balance sheet and the guy running the business, you better like them both"- Peter Lynch

Welcome to the next installment of our Substack series on finding quality companies! We’ve already explored ROIC and business models to help you pick great companies. Today, we’re zooming in on a critical piece of the puzzle: management.

A company can have a fantastic product, but if its leaders aren’t up to the task, it’s like having a boat without a captain; it might not make it far. I want to invest in companies run by great managers, so let’s break down how to evaluate management by looking at their background, track record, and whether they have “skin in the game.” We’ll use real-world examples to make this actionable, and I’ll show you how to dig into these details using company websites and public filings.

If you missed the previous post in this series, check it out:

How to analyze a company - this provides high-level steps to analyze a company like a pro investor

Next in this series:

Moat & Risks

Growth, Profitability & Healthy Balance Sheet

Future Growth & Valuation

Don’t forget to subscribe so you don’t miss the rest of this deep-dive series.

Each topic is designed to give you practical tools and knowledge to analyze businesses like a pro.

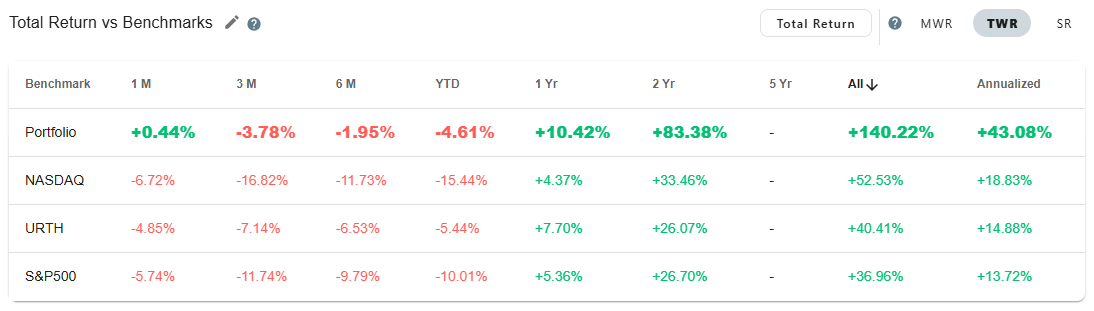

Following a consistent process and checklist has helped Steady Investing's portfolio (as of 4/21/2025) outperform the S&P 500 by over 100% - up 140% vs. 37% for the S&P 500 index—with an annualized return of over 43% (inception date Nov’22).

Let’s dive in!

Management: Track Record & Skin in the Game

Who runs the company matters as much as the business itself

You can find a great business with a strong moat and healthy financials, but if the wrong people run it, that edge can disappear fast. On the flip side, great managers can transform average businesses into long-term winners.

As investors, we may not be sitting in the boardroom, but we can still evaluate whether the people running the company have the integrity, discipline, and alignment to create lasting value

1. Why Management Quality Matters

Great managers can turn a struggling company around, while poor ones can sink even the best businesses. As an investor, I look for leaders with a strong history of success and a personal stake in the company’s future. Specifically, I prefer companies where managers have “skin in the game”—meaning they own a significant amount of stock and their compensation is tied to long-term stock performance, not just cash bonuses. This aligns their interests with mine as a shareholder, ensuring they’re focused on creating lasting value.

The best managers do three things well:

Operate the business efficiently

Invest capital wisely

Treat shareholders like long-term partners

As Charlie Munger once said, “Show me the incentive and I will show you the outcome.” That’s why understanding a CEO’s incentives and behavior is so important.

2. Dig Into Management’s Background

✅ Track Record

Start by digging into what the CEO and leadership team have done before.

Have they led this company or another through meaningful growth?

Do they have experience relevant to the business or industry?

Are they capital allocators or just operators?

Have they delivered shareholder returns over long periods?

Let’s take NVIDIA as an example. On NVIDIA’s website, under the “Leadership” section, you’ll find Jensen Huang, the CEO since he founded the company in 1993. Huang has a degree in electrical engineering from Stanford and started NVIDIA with a vision for graphics processing units (GPUs). Before NVIDIA, he worked at Advanced Micro Devices (AMD), a semiconductor company, giving him deep industry experience. Over 30 years, Huang has grown NVIDIA from a startup to a $3 trillion tech giant by 2024, leading the AI chip revolution. That’s a CEO with a stellar background—deep expertise and a long history of innovation in tech.

Compare that to a hypothetical company where the CEO is new to the industry, with no prior leadership roles in tech. I’d be cautious—experience matters, especially in fast-moving sectors like technology.

How to Research: Go to the company’s website and find the leadership bios. Look for their education, past roles, and years in the industry. Also, check LinkedIn or news articles for more context on their reputation and past achievements.

✅ Skin in the Game

This is where things get really interesting.

I prefer to invest in companies where the management team owns a meaningful amount of stock. Why? Because their incentives are now aligned with yours as a shareholder.

If the stock goes down, they lose. If the stock rises over time, they benefit, just like you. This shows they’re committed to the company’s future, not just short-term gains

Things to look for:

Insider ownership: How much stock does the CEO or founders own?

Are they consistently buying shares with their own money?

Do they hold shares long-term or sell frequently?

Founder-led companies often have this naturally baked in. Think of Jeff Bezos at Amazon, Mark Leonard at Constellation Software, or Reed Hastings at Netflix in the early days.

✅ Compensation Structure

It’s not just about ownership, it’s about how they’re paid.

The best companies structure executive pay to reward long-term performance, not short-term stock price bumps.

Look for:

Stock-based compensation tied to multi-year targets

Minimal reliance on short-term cash bonuses

Avoid companies that reward revenue growth at all costs without profitability or return thresholds

You can find this information in the company’s proxy filings (DEF 14A), typically available on the investor relations page or the SEC website.

Let’s look at NVIDIA again. According to NVIDIA’s 2024 proxy statement, Jensen Huang owns about 3.5% of the company, over 86 million shares, worth $103 billion at $1,200 per share. That’s serious skin in the game! His 2024 compensation was $34.2 million, with 90% in stock awards and only 10% in cash. This structure incentivizes Huang to focus on long-term growth, as his wealth grows only if the stock does well over the years.

3. Red Flags to Watch Out For

Excessive stock sales by insiders

Large cash bonuses unrelated to company performance

Management is making big promises without long-term execution

Short CEO tenure with high executive turnover

Lack of clear communication with shareholders

Red Flags: Be wary if management owns little stock or if their pay is mostly cash. For example, if a CEO owns less than 0.01% and gets 80% of their pay in cash, they might prioritize short-term profits (to boost their bonus) over long-term value. Also, some industries, like banking, limit insider ownership to avoid conflicts of interest, so check industry norms.

4. Examples of Great Capital Allocators

Mark Leonard (Constellation Software) – Rarely gives interviews, but his shareholder letters are a masterclass in long-term thinking and disciplined M&A.

Jeff Green (The Trade Desk) – CEO with long-term vision, strong insider ownership, and transparent communication.

Warren Buffett (Berkshire Hathaway) – The gold standard for aligning management and shareholder interests.

5. Where to Research Management

Company’s Investor Relations website (executive bios, shareholder letters, proxy filings)

SEC Filings – DEF 14A for compensation, 10-K for strategy and discussion

Insider trading reports – Look for Form 4 filings

LinkedIn & interviews – Understand background, communication style, and public philosophy

Final Thoughts

As investors, we’re buying into more than just numbers—we’re buying into people. And people drive outcomes.

Great management may not guarantee success, but poor management almost guarantees failure.

By prioritizing track record, alignment, and incentives, you can stack the odds in your favor

That’s it for today!

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks. Steady Investing has a true passion for investing and helping other investors.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, outperformed the S&P 500 by over 100%—up 140% vs. 37% for the index—with an annualized return of over 43%!.

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.