Hello Readers,

In today’s article, I want to introduce Aswath Damodaran, who has done an amazing job on simplifying Valuations in his courses, which helped millions of students understand the basics of how to value a company or an asset. I personally learned a lot from his classes.

Valuation class Aswath Damodaran

Aswath Damodaran, often referred to as the "Dean of Valuation," is a renowned finance professor, author, and blogger recognized for his significant contributions to the field of valuation. His work emphasizes the importance of distinguishing between an asset's market price and its intrinsic value, advocating for investment decisions based on fundamental analysis rather than market sentiment.

He has taught millions of people how to value a company.

Today, I am sharing his valuation class with you, download by clicking on the button below:

High-level overview:

Price vs Value

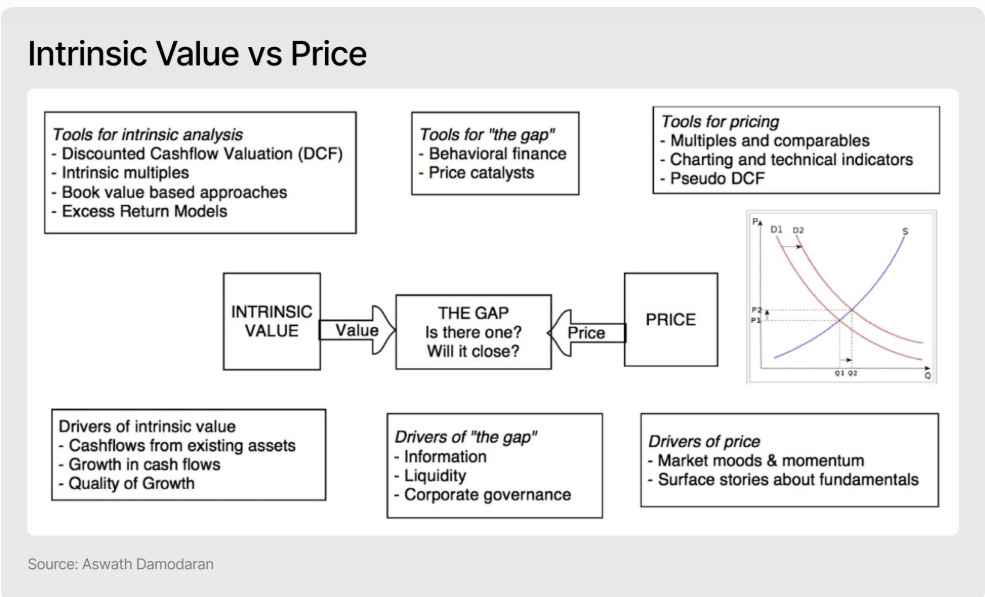

One of the core principles Aswath Damodaran emphasizes is the distinction between price and value. Price is what an asset trades for in the market, driven by supply, demand, sentiment, liquidity, and macroeconomic factors. Value, on the other hand, represents the intrinsic worth of an asset based on its fundamentals.

Understanding this distinction is crucial for successful investing. If you can accurately estimate an asset’s value and compare it to its market price, you can identify profitable opportunities. When the market price is significantly lower than the estimated value, it may present a strong buying opportunity. Conversely, if the price far exceeds the intrinsic value, it could be a sign to sell or avoid the asset.

Many investors get caught up in market trends and emotions. Recognizing that price is often dictated by sentiment while value is grounded in fundamentals can help prevent impulsive decisions driven by fear or greed."

The Corporate Life Cycle

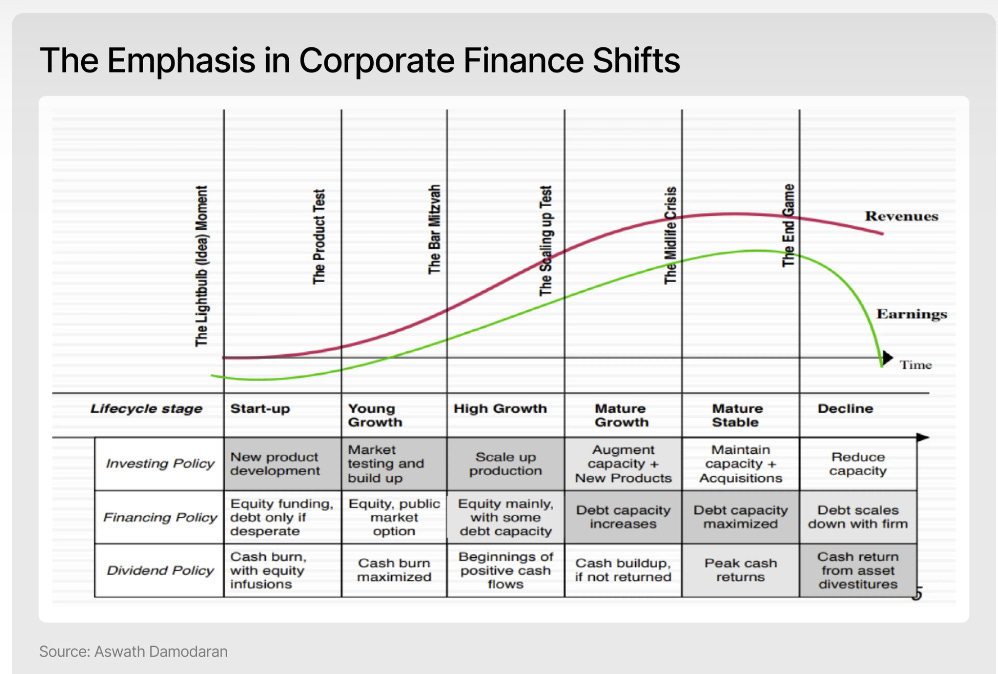

Aswath Damodaran likens companies to living organisms, each progressing through distinct life stages, from inception to potential decline. Each phase comes with unique challenges, requiring different management strategies, financial priorities, and valuation approaches.

The Shifting Focus in Corporate Finance

Start-Up Phase: At this stage, a company is transforming an idea into a viable business. The primary focus is on product development, market validation, and customer acquisition. Risks are high, and many startups fail before reaching profitability.

Growth Phase: Once a company achieves product-market fit, it enters a period of rapid expansion. The key challenges revolve around scaling operations, increasing market share, and securing investment to sustain growth. Capital efficiency and competitive positioning become crucial.

Mature Phase: Growth begins to stabilize, and the emphasis shifts from expansion to efficiency, profitability, and market leadership. Companies in this phase often have strong brand recognition, steady cash flows, and focus on optimizing operations rather than aggressive expansion.

Decline Phase: Not all companies reach this stage, but those that do face declining market relevance due to factors like outdated products, industry disruption, or shifting consumer preferences. The challenge is to either innovate and adapt or strategically manage the decline to maximize remaining value.

Understanding these phases helps investors and business leaders anticipate challenges and adjust strategies accordingly, ensuring long-term success and sustainable growth.

The Four Levers of Valuation:

As an investor assessing a company's value, every element of its narrative should tie directly to fundamental valuation drivers. Attributes such as a strong brand, rapid market expansion, a visionary CEO, potential bankruptcy risks, upfront capital requirements, or powerful network effects all shape key financial projections.

Each of these factors impacts critical valuation levers:

Revenue Growth: A strong brand, market expansion, or network effects can drive sustained top-line growth.

Profit Margins: Business model efficiency, economies of scale, and competitive positioning influence long-term profitability.

Reinvestment Needs: Capital-intensive businesses require significant reinvestment, affecting free cash flow and return on capital.

Risk Profile: Factors like financial stability, industry cyclicality, and management execution determine the risk premium applied in valuation.

By integrating these qualitative elements into financial projections, investors can craft a more comprehensive and realistic valuation model, ensuring that the narrative aligns with the numbers.

That’s it for today!

Conclusion:

Price is what you pay, value is what you get. Valuing a company is an important part of the analysis for an investor.

What a company trades in the market is based on supply and demand. As an investor, you wait for the market inconsistencies and buy the stock when it is undervalued.

Market swings based on the short-term news. This can be an advantage for an investor to purchase great companies at low prices.

Understanding what stage of the business cycle is very important. As an investor, you use the growth values based on the state of the cycle and compare them with similar stage companies.

Valuation is an Art more than a Science. The more you practice, the better you become at it.

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since tracking my performance, I have beaten the S&P 500 Index every year on an average of 19%and have achieved a 40% compound annual growth rate (CAGR).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Gonna have to take some time to read this properly.

the download link does't work