Capital Allocation - Everything you need to know!

Great Mangers are the ones who are great at Capital Allocation!

Mastering Capital Allocation: The Key to a Company’s Success

Welcome to Saturday Stock School! We’re here to demystify stock investing with a quick lesson every week. Today, we’re diving into capital allocation—the most crucial job of any management team, capable of building or breaking a company. I’ll guide you through what it is, why it matters, and how to spot great allocators with examples from Apple, Microsoft, and Visa. Let’s explore this step by step!

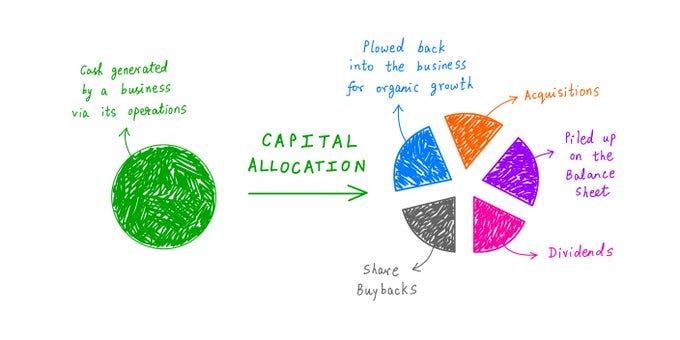

What Is Capital Allocation?

Capital allocation is how a company decides to use the cash it earns from its business. Profitable companies generate cash in unique ways:

Apple makes money selling iPhones, McDonald’s earns from hamburgers, and Kinsale Insurance profits from selling E&S Insurance. Once that cash is in hand, management must choose where to put it to work for the best return. This isn’t just a financial decision, it’s a moral duty to shareholders who trust them with their investment.

The Challenge: Most CEOs Aren’t Trained for This

Surprisingly, most CEOs rise through roles in sales, marketing, or R&D, not finance. When they step into the top job, they often lack experience in capital allocation—the very task that can make or break their company. As an investor, you need to seek out companies with management teams that prove they can allocate capital wisely. A great example is Visa, which has a clear strategy: it reinvests in its payment network, maintains a strong balance sheet, and returns cash to shareholders through buybacks, driving consistent growth (its stock rose 20% in 2024 alone).

The Four Capital Allocation Options

Companies generally have four ways to use their cash. Let’s break them down with examples and insights.

1. Organic Growth: The Compounding Magic

Organic growth, reinvesting earnings into the business, is the top choice when a company can earn high returns. Look for firms with a high and stable Return on Invested Capital (ROIC). A high ROIC with reinvestment opportunities creates a “compounding machine.”

Example: Company A (High-Growth Tech) vs. Company B (Great Coffee Company)

Both companies start with a $10 stock price but have different earnings growth rates.

Projecting Earnings Growth Over 5 Years

We calculate future EPS assuming consistent annual growth.

Company A (High-Growth Tech Firm, 35% EPS Growth per Year)

Company B (Mature Business, 5% EPS Growth per Year)

Impact on Stock Price Over 5 Years

For simplicity, let’s assume both companies maintain their current P/E ratios (though in reality, a high-growth company’s P/E may compress as earnings grow).

Company A (Tech, High Growth)

Stock Price=1.12×40=$44.8

Stock price increases from $10 → $44.8 in 5 years (348% gain).

Company B (Mature, Slow Growth)

Stock Price=1.28×10=$12.8

Stock price increases from $100 → $128 in 5 years (28% gain).

High P/E companies can deliver massive returns if growth materializes.

Even though Company A looked “expensive” at 40 P/E, its rapid earnings growth resulted in substantial stock appreciation over 5 years.

Company B, despite its low P/E (10), struggled to generate meaningful returns due to slow earnings growth.

Investors should look beyond P/E in isolation and focus on earnings growth potential over multiple years.

This is why companies like Amazon (AMZN), Tesla (TSLA), and Nvidia (NVDA) had high P/E ratios for years but delivered exponential returns.

2. Strengthen the Balance Sheet: Safety First

Using cash to pay down debt or build reserves strengthens a company’s financial health, especially if it’s struggling. A robust balance sheet offers flexibility during tough times.

Example: Microsoft

Bill Gates insisted Microsoft keep enough cash to survive 12 months without revenue, now over $75 billion in 2024. This cushion let Microsoft weather the 2020 pandemic dip and invest in Azure, growing cloud revenue 30% to $110 billion. A strong balance sheet is a safety net, making it a smart move when debt is high.

3. Mergers and Acquisitions (M&A): Tread Carefully

M&A - buying other companies can boost growth, but is risky, with 60-90% of deals destroying value due to overpayment or poor integration. Be cautious unless management has “skin in the game” (their pay tied to success) and a proven acquisition track record.

Example: Danaher

Danaher’s serial acquisitions, like its $21 billion buy of GE Biopharma in 2023, have boosted revenue 15% annually, thanks to a culture of integration excellence. Contrast this with a failed deal like AOL-Time Warner (2000), which lost $99 billion in value. M&A works only with disciplined, proven teams.

4. Return Capital to Shareholders: When Growth Fades

When growth opportunities dwindle, companies return cash via dividends or share buybacks. Check dividend yield (2-4% is solid) and payout ratio (below 60% is sustainable) for dividends. Buybacks create value only if the stock is undervalued.

Example: Coca-Cola

Coca-Cola’s 3.3% dividend yield (2024) and 60% payout ratio make it a dividend aristocrat, raising payouts for 62 years. For buybacks, imagine Company A (P/E 5, $10 stock) buys back $3 million worth (300,000 shares), boosting your 1% stake to 1.42%. Company B (P/E 25, $50 stock) buys the same amount (60,000 shares), lifting your stake to 1.06%. Cheaper stocks amplify buyback benefits.

Why This Matters to You

Great capital allocation drives stock performance. Apple’s reinvestment built a $3 trillion market cap, Microsoft’s cash reserves fueled growth, Danaher’s M&A added value, and Coca-Cola’s dividends reward shareholders. Poor allocation—like overpaying for acquisitions—can sink returns. Backing companies with skilled allocators sets you up for success.

In the long run, great capital allocation creates compounding machines.

Want proof? Read The Outsiders by William Thorndike — it highlights 8 CEOs who crushed the S&P 500 by focusing obsessively on smart capital deployment.

Conclusion

Look for:

A clear capital allocation strategy (e.g., Visa’s balanced approach).

High ROIC with reinvestment (e.g., Apple’s 30%).

Proven M&A success (e.g., Danaher).

Sustainable returns to shareholders (e.g., Coca-Cola’s 60% payout).

Check annual reports or earnings calls on company websites for these details.

About Me

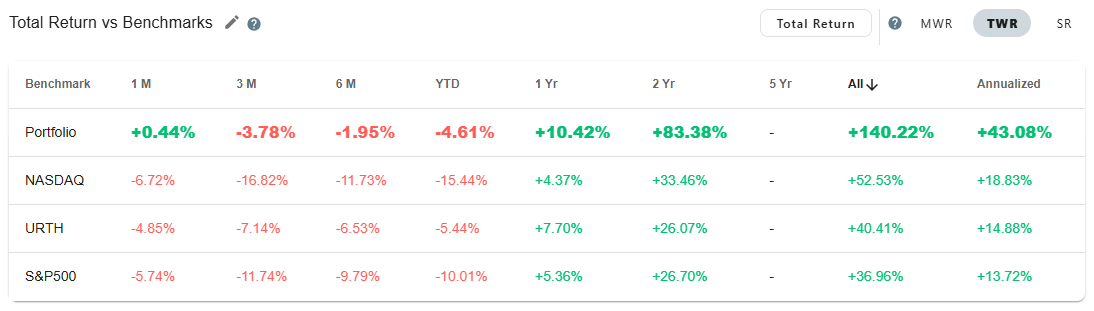

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks. Steady Investing has a true passion for investing and helping other investors.

I did not come from a finance background, and it took me nearly 10 years from learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, I have outperformed the S&P 500 by over 100%—up 140% vs. 37% for the S&P 500 index, with an annualized return of over 43% (inception date Nov’22).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.

Important topic, critical skill to get right for any company builder!