We love volatility!

I have quite a few companies on my watchlist trading at excellent prices.

Let’s start with the “Fear & Greed Index” to see what emotion is driving the market now. This morning, it slightly ticked up to 5 and dropped back to 4 after Trump announced 104% tariffs on China. The market is in “Extreme Fear” mode, trying to make sense of how all this chaos will end.

In the last 25 years, we only saw this low score twice:

During the 2008 Financial Crisis

During COVID-19 Pandemic

This is a good time to go shopping. But do remember that buying any company that is hitting new bottoms doesn’t mean you are buying at a bargain. We need to go back to the basics, look at the companies we have in our watchlist, and reevaluate if the business fundamentals are still strong before clicking that BUY button

If you are wondering how to create a watchlist with “quality” companies, check out my post on “How to Build a Stock Watchlist”.

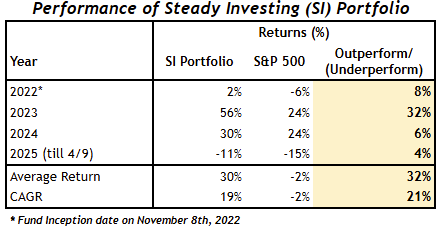

Steady Investing Portfolio Performance:

We’ve outperformed the market every year since inception, and we’re proud to continue that trend in 2025. As of this morning (April 9th, 2025), our portfolio is up 4% ahead of the S&P 500 year-to-date.

We’re very pleased with the results so far—especially during a volatile period—proving once again that high-quality businesses tend to hold up well when markets get shaky.

In my recent note, I shared how I’ve been using this volatility to reallocate capital and strengthen the portfolio. I’ll dive into the details of those moves in my next post. Subscribe to not miss it!

Before you dive into the analysis, if you want a refresher on how I value a company, please see my post on “How to Analyze a Company.”

5 - Adobe

Business Model?

Adobe operates a Software-as-a-Service (SaaS) model focused on creative, digital media, and marketing tools. One of the products that most of us use is Adobe PDF reader.

How do they make money?

Digital Media (~75% of revenue): Flagship products such as Photoshop, Illustrator, Acrobat, Premiere Pro, Lightroom

Digital Experience (~20%): Enterprise-grade tools such as Adobe Experience Cloud, for marketing automation, analytics, and content personalization

Publishing & Other (~5%): Legacy tools and niche products (e.g., eLearning, print publishing)

Long-Term Growth Prospects?

1. Digital Transformation- Growth in remote work, paperless offices, content creation, e-signatures.

2. AI & Firefly- Generative AI integrated into Creative Cloud; lowers user barriers & boosts productivity.

3. Enterprise Growth- Adobe Experience Cloud enables marketing automation, personalization, and analytics for large businesses.

4. Global Expansion-Increasing adoption in emerging markets; localized pricing and interface improvements.

5. Ecosystem Lock-In- Deep product integration, high switching costs, and widespread industry adoption.

6. Financial Strength- Strong free cash flow funds R&D, buybacks, and potential acquisitions.

Why is Adobe a quality business?

Adobe’s products are the industry standard

The company should be able to benefit from AI in the years to come

10- year Revenue & EPS growth are 17.9% & 37.9% respectively

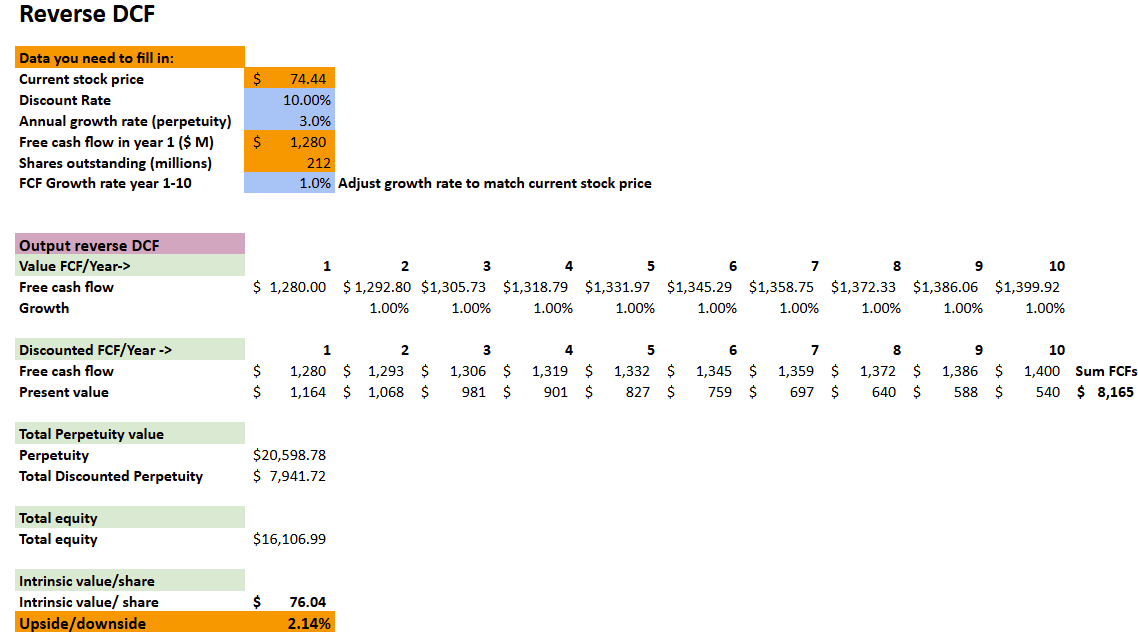

Valuation:

Expected Return using Earnings Growth Model: 17%, which is great!

Reverse DCF: Adobe should grow FCF at 8% per year to return 10%* per year to the shareholders, which I believe can be achieved and exceeded for years to come.

I believe the company is undervalued by ~50%

*I use 10% as my threshold—my opportunity cost of capital. If I don’t believe a company can generate at least a 10% annual return, I’d rather invest in the S&P 500 index.

4 - PayPal

Business Model?

PayPal operates a two-sided platform that connects consumers and merchants to enable secure online and mobile payments. It serves as a digital wallet for users and a payment processor for businesses.

How do they make money?

1. Transaction Revenue (~90% of total revenue)

Fees charged to merchants for processing payments (typically ~2.9% + $0.30 per transaction in the U.S.).

Includes payments from PayPal, Venmo, Braintree, and Xoom.

2. Value-Added Services (~10%)

Interest income from customer balances (PayPal is not a bank, but it earns interest on held funds).

Instant transfer fees (e.g., from Venmo/PayPal to a bank).

Merchant and consumer credit products (PayPal Working Capital, PayPal Credit).

Fraud management and risk services for enterprise clients.

Long-Term Growth Prospects?

Expansion into in-store payments and BNPL (Buy Now, Pay Later)

Deeper integration with e-commerce platforms

Growth in Venmo monetization (e.g., business profiles, crypto, debit card usage)

Strengthening financial services offerings (e.g., high-yield savings, credit)

Valuation:

Expected Return using Earnings Growth Model: 15%. I was very conservative here and still seeing a great return!

They have started a $20B share buyback program! Which will have a significant impact on the share price.

Reverse DCF: PayPal should grow FCF at 0(!)%, you saw that right, per year for the next 10 years, and 2% growth perpetuity to return 10% per year to the shareholders. Which I think is great news for investors. Additionally, PYPL is not in an industry that is seeing overall decline; it is growing.

I believe the company is undervalued by ~70%

3 - Medpace

Business Model?

Medpace is one of the world’s leading clinical Contract Research Organizations (CRO), by revenue, solely focused on providing scientifically-driven outsourced clinical development services to the biotechnology, pharmaceutical, and medical device industries.

How do they make money?

1. Service-Based Revenue (100% of revenue)

Medpace earns revenue by managing clinical trials for clients in exchange for service fees.

Revenue comes from multi-year contracts, typically tied to milestones (e.g., study initiation, patient enrollment, data analysis).

2. No Product Risk

Medpace does not own any drugs, it simply provides services.

This lowers operational risk and makes revenue more predictable.

Long-Term Growth Prospects?

Growing global demand for clinical trials, especially from small- and mid-cap biotechs

Expansion into complex disease areas (oncology, rare diseases, gene therapy)

Increasing outsourcing trend in the pharmaceutical industry

Medpace’s reputation for speed, quality, and full-service integration

Valuation:

Expected Return using Earnings Growth Model: 14%, great return!

Reverse DCF: At the current stock price of $275, Medpace should grow FCF at just 4% per year for the next 10 years to return 10% per year to the shareholders. Expected FCF growth is ~14%.

I believe the company is undervalued by ~70%

2 - Judges Scientific

Business Model?

Judges Scientific is a UK-based company that follows a “buy and build” strategy. It acquires and operates a portfolio of small, highly specialized companies that manufacture scientific instruments. Universities, research labs, and industrial R&D departments around the world use these instruments.

How do they make money?

1. Product Sales (Core Revenue Stream)

Judges’ subsidiaries manufacture and sell high-precision scientific instruments, including thermal analysis tools, gas analyzers, and mechanical testers.

Revenue is generated from one-off capital equipment sales to academic institutions, research labs, and industry clients.

2. Aftermarket & Service Revenue

Once equipment is sold, Judges earns recurring revenue through:

Maintenance contracts

Calibration services

Replacement parts and software updates

This creates a stable and sticky revenue stream with higher margins.

3. Acquisition-Driven Growth

Judges acquires profitable, niche scientific businesses with strong management and global demand.

Acquired businesses retain operational independence while benefiting from centralized governance and capital allocation.

Long-Term Growth Prospects?

Decentralized structure: Individual businesses operate independently, fostering accountability and efficiency.

High ROCE & Gross Margins: The company only acquires businesses with proven profitability and durable niche markets.

Gross margins have been growing consistently over the last 10 years!

Inorganic growth through disciplined M&A (2–4 acquisitions per year)

Growing global demand for scientific instrumentation in academia, pharma, energy, and materials science

Increased R&D investment globally, especially in emerging markets

Valuation:

Expected Return using Earnings Growth Model: 11%, great return!

Reverse DCF: JDG should grow FCF at just 7.5% per year for the next 10 years to return 10% per year to the shareholders. Expected FCF growth is ~14%.

I believe the company is undervalued by ~75%

1 - Evolution AB

Business Model?

Evolution Gaming is a market leader in developing fully integrated B2B Online Casino solutions. The core of their offering is traditional table games like Roulette & Blackjack in the US, Europe, Asia & other countries.

How do they make money?

1. Revenue Share Model (Primary Revenue Stream)

Evolution partners with online casino operators and takes a percentage of the gaming revenue generated from its games. The more users play, the more revenue Evolution earns.

2. Fixed Licensing Fees

Some operators pay monthly licensing fees for access to Evolution’s game suite, depending on volume and arrangement. These provide a stable baseline revenue.

3. Live Games

Offers unique live game show experiences (e.g., Crazy Time, Monopoly Live), which are highly engaging and lucrative.

Long-Term Growth Prospects?

Online Gambling became legal in 2005 & 2006 in the US and Europe and has seen significant growth since. Online Gambling is expected to reach $63 billion just in the US by 2030. EVO has 70% of the market share of this growing business, the clear market leader

Valuation:

Expected Return using Earnings Growth Model: 22% per year. That’s almost 2X if you invest in the S&P 500 index.

Reverse DCF: EVO.AB ($EVVTY) should grow its FCF by 1% per year to return 10% per year to shareholders.

I believe EVO.AB is undervalued by ~110%

About Me

I am a self-taught investor who has read hundreds of books on investing and spends 40+ hours a week researching and analyzing stocks.

I did not come from a finance background, and it took me nearly 10 years from first learning about the stock market to finally making my first investment. Since 2022, when I started tracking my performance, I have beaten the S&P 500 Index every year on average by 19% and have achieved a 40% compound annual growth rate (CAGR).

I created this platform to share my investing journey and help others navigate the stock market with confidence.

Let’s grow together. 🚀

Visit my page to access previous posts.

Disclaimer: This post is for educational purposes only and should not be considered financial advice. Always do your research before making investment decisions.