Stock Analysis: America Runs on...It's not Dunkin', Its Old Dominion Freight Line😃

One of the best run Less-than-Truckload (LTL) carriers in North America

Dear Readers,

This is my first post delving deep into one of the companies I have been researching: ODFL

I want to provide context on the structure of these posts. Structure and how I analyze a company:

General Information

Business Model

Management - Track Record & Skin in the Game

Moat - Does the company have a competitive advantage

Risks

Growth, Profitability & Health of Balance Sheet

Capital Allocation

Future Growth Expectations - Company’s guidance & Analysts expectations

Valuation

Final Thoughts & Recommendations

I think this covers everything we need to analyze a company to make a decision but I would love to get feedback from the community if anything else you see as important information to consider.

Old Dominion Freight Lines (ODFL)

1. General Information:

ODFL is one of the best-performing stocks in the Freight business. Since going public in 1991, the company has returned 28.2% CAGR

If you had invested $10,000 in 1991, your investment would have turned into $3.3M. That is a hopping 32,995.5% return!

Ticker: ODFL

Current Stock Price: $175 (as of 2/26/2025)

Market Cap: $37.5 B

PE Ratio (TTM): 32

2. Business Model:

Old Dominion Freight Line (ODFL) was founded in 1934 and it is a leading North American less-than-truckload (LTL) motor carrier, providing regional, inter-regional, and national LTL services, including expedited transportation. It also provides various value-added services, including container drayage, truckload brokerage, and supply chain consulting. As of December 31, 2023, it owned and operated 10,791 tractors, 31,233 linehaul trailers, 15,181 pickup and delivery trailers; 46 fleet maintenance centers; and 257 service centers.

How do they make money?

Old Dominion Freight Line (ODFL) makes money primarily through its less-than-truckload (LTL) freight services, where it transports smaller shipments that don’t require a full truckload. Here’s a breakdown of its business model and revenue streams:

1. Less-than-truckload (LTL) Freight Services (~98% of Revenue)

ODFL operates as a pure-play LTL carrier, meaning its entire business is focused on transporting smaller shipments for businesses across various industries. The company generates revenue from two main pricing components:

Freight Volume – The number of shipments and weight per shipment.

Revenue per Hundredweight (Yield) – The pricing per unit of weight, which includes base rates, fuel surcharges, and additional service fees.

Unlike some competitors, ODFL does not have a full truckload (FTL) division, brokerage, or logistics business, making it highly specialized in LTL.

2. Revenue Breakdown (Key Metrics):

ODFL does not officially segment revenue beyond LTL freight, but here are key revenue drivers:

LTL Revenue per Shipment: Driven by shipment weight, distance, and pricing power.

LTL Revenue per Hundredweight: Reflects pricing discipline and ability to pass on costs.

Fuel Surcharges: Adjusted based on diesel prices, contributing to overall revenue.

How ODFL compares to its competition:

Premium Pricing & Service Quality: ODFL competes on service rather than price, allowing it to charge higher rates than many LTL peers.

Industry-Leading Operating Ratio (~70%): ODFL is one of the most efficient LTL carriers, it keeps a large portion of revenue as profit.

Asset-Based Model: Unlike competitors relying on third-party trucking capacity, ODFL owns and operates its fleet and terminals, enhancing reliability.

3. Management:

CEO & President - Kevin Freeman- He has been with the company for over 30 years. Freeman assumed the roles of President and CEO on July 1, 2023, succeeding Greg C. Gantt. Before this, he served as the company's Chief Operating Officer (COO) and has been with ODFL since 1992, holding various positions over his tenure.

EVP & CFO - Adam Satterfield - He has been with the company for over 20 years. He was promoted to CFO on July 1, 2023, after serving as our SVP of Finance & CFO since 2016. Mr. Satterfield also served as Vice President - Treasurer from 2011 to 2016, as Director - Finance and Accounting from 2007 to 2011, and as Manager - SEC Reporting from 2004 to 2007.

EVP & COO - Gregory Plemmons - He has over 34 years of transportation industry experience and has been with ODFL for over 23 years. He assumed his role on July 1, 2023, after serving as SVP of sales since 2019. He also served as Vice President – Field Sales from 2013 to 2019 and as Vice President – OD Global from 2002 to 2013.

Top management together has over 85 years of experience in the transportation industry. The leadership team's long-standing commitment to ODFL reflects a deep understanding of the company's operations and culture, contributing to its sustained success in the freight and logistics industry. Additionally, Ex-CEO David Congdon - who has a 5.5% stake in ODFL is still on the Board of Directors.

4. Moat & Competetive advantage:

Extensive, High-Quality Network: ODFL has built a dense and well-integrated nationwide network of service centers (Hub & Spoke Model) that allows for efficient routing, and timely deliveries & reduces costs.

Superior Service & On-Time Performance: ODFL consistently ranks #1 in on-time performance (above 99%) in the LTL industry.

Pricing Power & Cost Efficiency: Unlike some competitors that engage in price wars, ODFL maintains high margins due to its disciplined pricing strategy and focus on profitable freight.

Industry-leading Operating Ratio (sub-70% in recent years) shows superior cost efficiency.

Strong Brand & Customer Loyalty: The company has built a reputation for best-in-class customer service and low claims rates, leading to high customer retention.

Technology & Automation: ODFL invests heavily in automation, route optimization, and tracking technologies, improving efficiency and customer experience.

Its real-time freight tracking and digital tools help it stand out from traditional LTL carriers.

ODFL’s moat is built on superior service, cost discipline, network strength, and technology investment. It continues to outperform competitors by focusing on high-margin, high-quality freight rather than chasing market share through discounts.

Old Dominion has maintained its competitive position without compromising pricing discipline. This suggests the company's value proposition remains compelling even in a difficult market.

From all the information we get, it looks like we have maintained market share, and that's effectively what we target doing in a weaker economic period. We want to maintain our market share, continue to maintain discipline with regards to our yield management philosophy as well and then be in a good spot to start growing when the market does again.

-- Adam Satterfield, CFO

The barrier to entry: It is a very capital-intensive industry and it is very hard for a new player to enter. Even if a company with capital enters the market, it is hard to build the network, trust, and performance of ODFL.

The company maintained exceptional service metrics despite operational challenges, reinforcing its competitive advantage in service quality.

Our customers know they can rely on us to be there for them and help them keep their promises to their customers. I'm proud to report that, once again, [this was] the case in the fourth quarter as we provided our customers with 99% on-time service and a cargo claims ratio below 0.1%.

-- Kevin Freeman, CEO

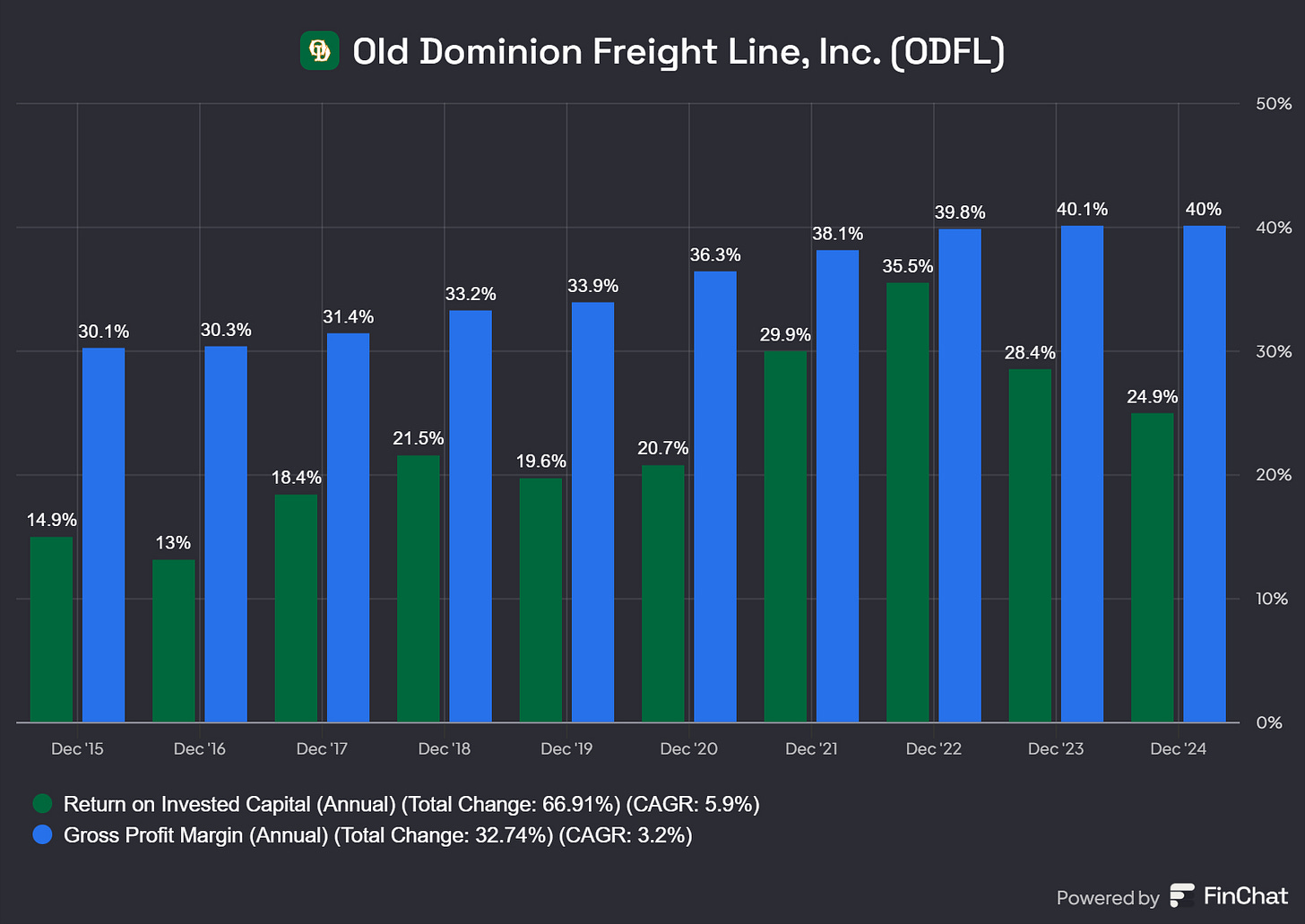

ODFL is maintaining strong Gross Margins of ~40% and ROIC of ~25%, Which are high compared to the industry average of 20% &13% respectively.

5. Risks:

While ODFL is the most profitable LTL carrier, every company comes with its risks that we need to understand as an investor. We cannot understand all the risks but thinking through them will help us understand if we are considering the Margin of error.

“Risk is what’s left after you thought of everything”

Economic slowdown & Cyclicality:

ODFL’s revenue is highly dependent on the health of the U.S. economy. During recessions or economic slowdowns, freight demand drops, leading to lower shipment volumes and revenue.

Cyclicality risk: The trucking industry is cyclical, meaning ODFL could face revenue declines in downturns, even if it maintains pricing power.

Competitive Pressures & Inflation:

It is a crowded industry with rivals like XPO, Saia (SAIA) & FedEx Freight competing for market share. If they reduce the pricing, ODFL may have to respond

Inflation will eat into its profitability as some of the costs cannot be pushed to its customers

Rising Costs (labor & Gas):

ODFL is heavily dependent on labor & Gas. Currently, it is non-union, there may be risks in the future for the employees to go union which may increase expenses. They have to increase pay to keep up with inflation

ODFL is heavily dependent on Diesel prices, which fluctuate a lot with economic conditions

Technology Disruptions & Automation:

ODFL has to stay ahead of the industry and keep up with incorporating new technology to make its operations efficient.

Self-driving will be a threat if they do not stay ahead of the curve or will be a great opportunity.

I believe ODFL has strong management and will stay on top of the risks and mitigate as much as possible.

6. Growth, Profitability & Balance Sheet health:

Growth:

Did the company grow at a good rate in the past?

Since IPO, ODFL has grown greater than 28% CAGR (my threshold>13%, 3% over the average market return)

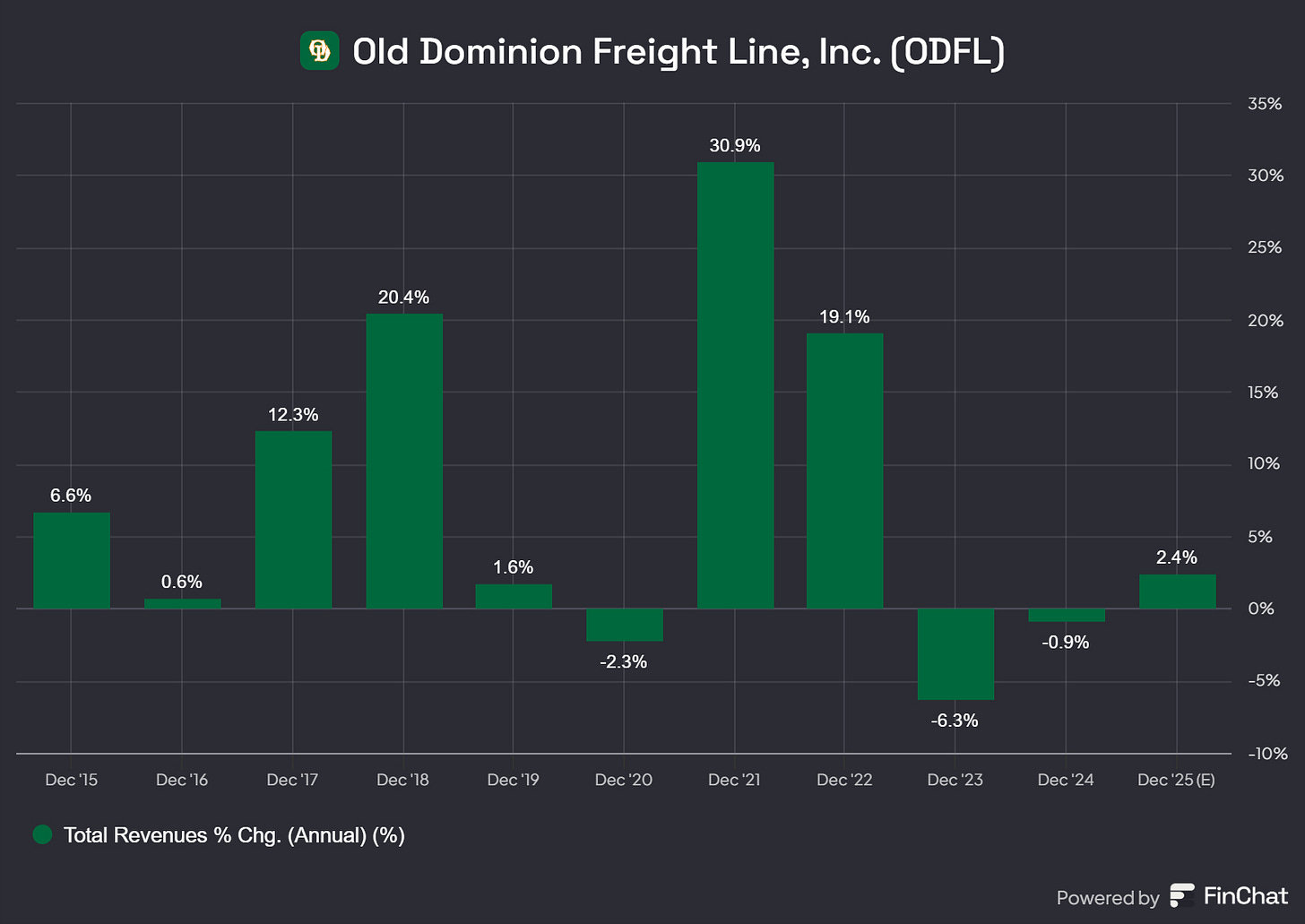

Revenue Growth: In the last 5 & 10 years, ODFL grew at 7.2% & 7.6% CAGR (my Threshold is >5%)

As mentioned in the “Risks” above, ODFL is pretty sensitive to the overall economy of the US.

Profitability:

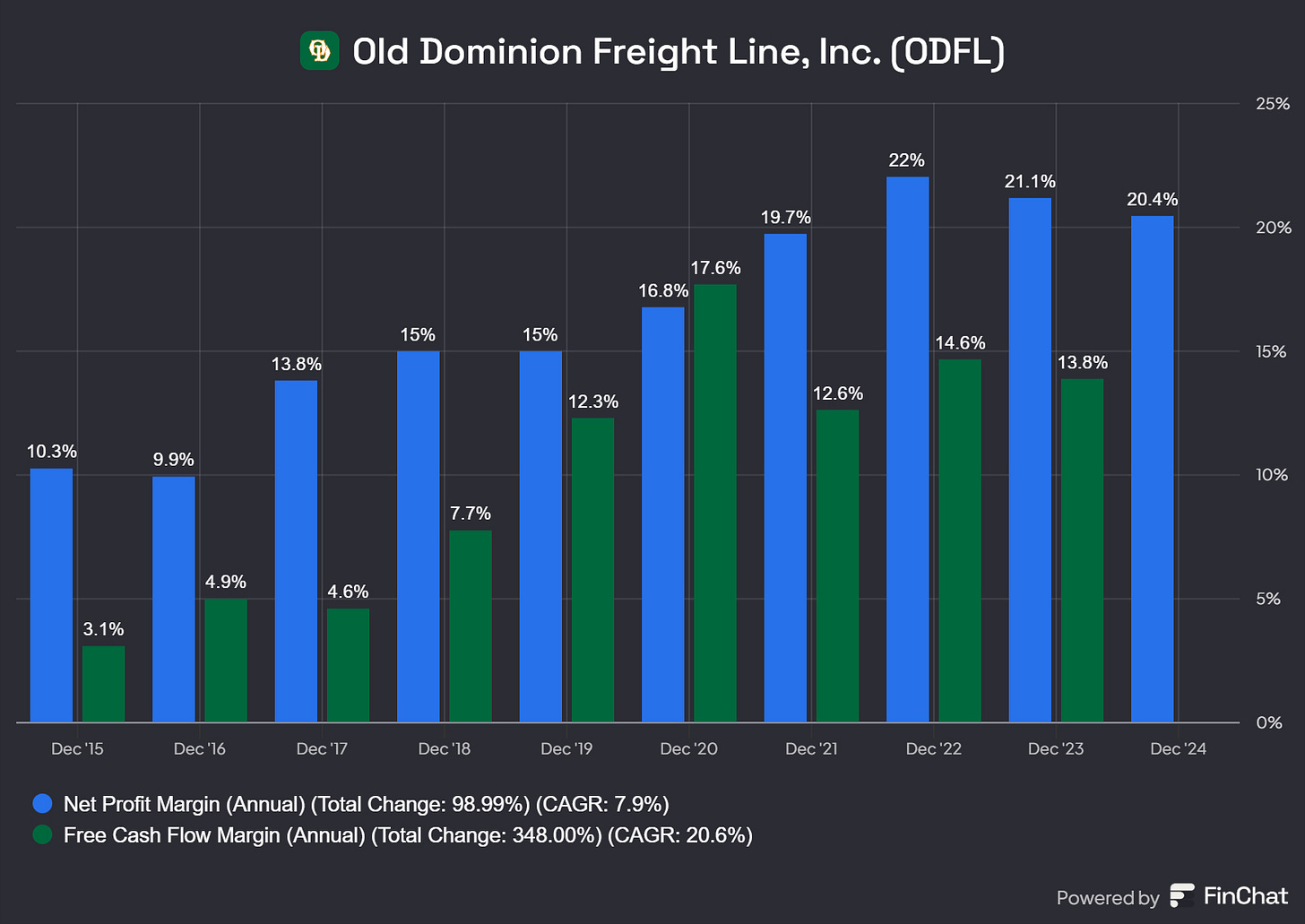

Net Profit Margin is ~20% in the last few years!

Free Cash Flow Margin: ODFL FCF's 5-year margin is 14% which means it is generating good cash flow from its core activities. Vs competitors <5%

Balance Sheet health:

Interest Coverage Ratio: I want to see this at least >20X. For ODFL it is >1,000X. Which means its interest charges are very low. ODFL uses cash from operations to fund CAPEX. Here is management’s view on CAPEX from MD&A :

We expect to fund these capital expenditures primarily through cash flows from operations, our existing cash and cash equivalents and, if needed, borrowings available under the Credit Agreement or Note Agreement

ODFL has very low debt, management is very cautious to take over debt and use cash from operations to fund growth. It has <$50M in Net debt

Net Debt/EBITDA: ~0

Very healthy balance sheet and conservative management. Love to see this!

7. Capital Allocation

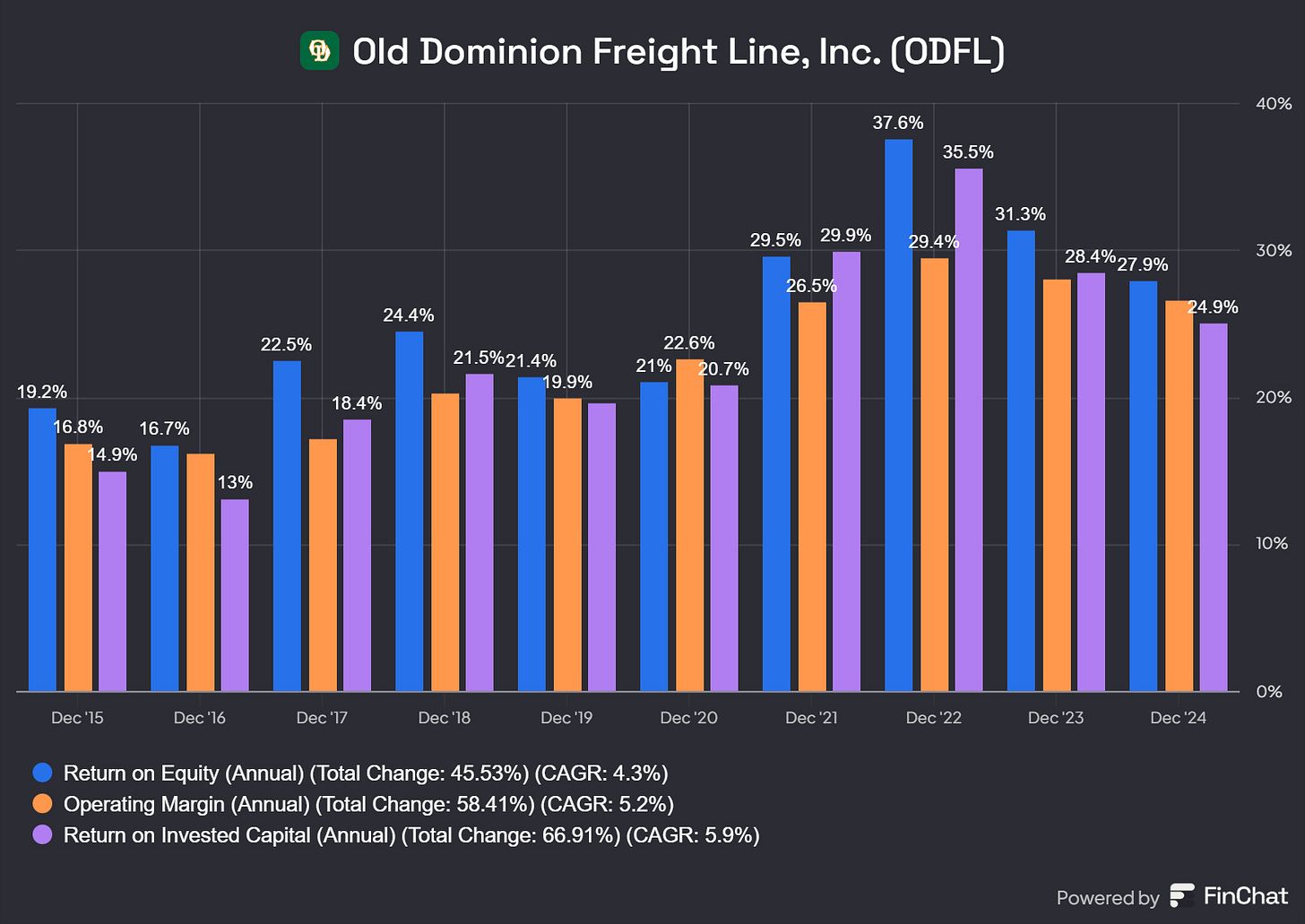

ODFL has a very attractive return on investments & best in this space when compared to competitors:

ROIC: ~25%

ROE: ~28%

Operating Margin >25%

Old Dominion continues making significant investments in its service center network, demonstrating confidence in long-term growth opportunities. The company spent $771 million on capital expenditures in 2024, following $757 million in 2023.

We spent $771 million on capital expenditures in 2024 which follows the $757 million in capital spending we executed in 2023. These figures include $664 million we have invested over the two-year period in the ongoing expansion of our service center network.

-- Kevin Freeman, CEO

8. Future Growth Expectations - Company’s guidance & Analysts expectations

Before we jump into future growth, I would like to see companies historical performance. It is important to understand how the company and the management grew their revenues and shareholders value overtime. This will help us understand if the mangement is capable to maintain long-term growth.

Past growth & Buybacks:

Revenue 10-year CAGR: 7.6% (>5%)

EPS 10-year CAGR: 18.2% (>8%) - like to see EPS growth higher than Revenue. That means company is getting efficient in running it’s operations.

Stock Repurchase: Company has approved to repurchase $3B worth of its outstanding shares. Which is ~10% of market cap. They have repurchased ~3% of outstanding shares on average in the last 3 years which I expect it to continue.

How does the Future hold?

Per management guidance and analyst expectations:

Revenue Growth 2-year CAGR: 8% (>5%). Slow FY25 and pickup in FY26

EPS Growth 2-year CARG: 10% (>8%)

ODFL is heavily spending on service centers which will help them become more established in the transportation space and gain market share. Additionally, service centers will help them improve customer satisfaction & more pricing power. I believe ODFL will still growing at a decent rate in the near future.

9. Valuation

I like to use 2 methods to understand the valuation of a company

Earnings Growth Model - I heard this from John Huber and I think one of the best ways to look at it

Reverse DCF

Earnings Growth Model:

Expected return = Earnings growth + Shareholder Yield +/- PE Expansion

Earnings Growth- 10% over the next 10 years

Shareholder yeild- 3.6% (0.6% + 3% annual share buyback)

PE Multiple Expansion- Forward PE might decline from current 32.4X to its 10 year historical average of 26.5X.

Expected Annual Return: 10% + 3.6% +0.1*((26.5-32.4)/32.4)= 11.8%

Expected Return of 11.8% is good. It is above the 10% threshold I want to see.

Reverse DCF:

We use the Reverse DCF analysis to understand growth rates that are already baked into the current stock price.

Inputs:

Current FCF : $915M (Stock based comp is small so excluded from this)

Adjust the expected growth in years 1-10 to figure at what growth rate the current stock price matches the Intrinsic Value/Share.

Discount Rate: The minimum expected return as an investor.

For ODFL at current stock price of $175.69 (as of 2/26/25) the FCF should grow at an annual growth rate of 19.2% to return 10% (discount rate used in the calculation) to the share holders.

I think at this growth rates, there is no Margin of Safety for the investors. ODFL is run by great management and they are capable of acheiving CAGR revenue growth >5% for over 10 years but there is no room for error.

10. Final Thoughts & Recommendations

A record-low claims ratio and 99% on-time delivery showcase operational strength despite market headwinds.

Strong Management with over 80 years of experience in the transporation industry

Great capital allocators - High Gross Margin & ROIC

Healthy Balance sheet - Almost no debt

Heavy capial investment (>750M), which shows commitment to long-term growth.

Conclusion:

ODFL is a great company managed by wonderful leaders. But the current valuation is high. I would love to buy the stock at a reasonable levels.

In case you missed you can see my previous posts here.

Fuel is offset by fuel surcharges baked into the contract. Based on the way they are written they actually OD earns a bit more than fuel costs and benefits from elevated fuel costs.